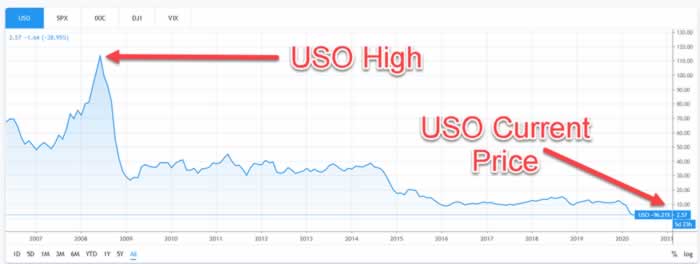

United States Oil Fund LP (NYSE: USO) has been around for 14 decades, and losses now are roughly 97% from a high of over $110 to now $2.57. USO is an exchange-traded fund (ETF) that tracks the futures market to give investors exposure to the price of oil. Haselkorn & Thibaut, a nationwide investment fraud law firm, is investigating potential sales practice violations by financial advisors who were recommending USO and other energy sector-related investments to retail main street investors.

United States Oil Fund, L.P. (Symbol: USO) – seeks the daily changes in percentage terms of its shares’ per share net asset value (“NAV”) to reflect the daily changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the price of a specified short-term futures contract on light, sweet crude oil called the “Benchmark Oil Futures Contract,” less USO’s expenses. USO seeks to achieve its investment objective by investing primarily in futures contracts for light, sweet crude oil, other types of crude oil, diesel-heating oil, gasoline, natural gas, and other petroleum-based fuels.

With substantial investor inflows in recent weeks, the USO stock ETF was a popular way for retail investors to get some market exposure.

However, ETFs are sometimes inadequately presented to retail investor clients by financial advisors. These products are popular investment vehicles for institutional investors and professional traders who want to gain exposure to a particular asset class or sector. ETFs such as USO are widely available and popular with retail financial advisors as well as robo-advisors. Here, financial advisors may not have fully explained the complexities of the oil futures markets (the underlying investment in the USO ETF.

Trading futures contracts on oil prices is not typically for main street retail investors. With extraordinary market volatility in this sector, it was not the time for most retail investors to get in or stay in. When some of the futures contracts went negative, it was likely a risk most investors (or even financial advisors that recommended USO) never expected (or disclosed). USO has declined over 65% year-to-date.

Why United States Oil Fund OSO Drop So Much April 2020?

Table of Contents

For financial advisors recommending USO to retail investor clients, it appears there may have been a significant “gap” in the disclosures. Many retail investors were under the mistaken impression they were actually investing in crude oil – they have now received some shocking news. What they were investing n were merely futures contracts.

Financial advisors recommending this investment fund to retail client should have clearly explained what the product was, and what they underlying investment really consisted of, so that investor clients could have made informed decisions based on accurate information. The purpose of this investment fund was to track the front-month oil futures contracts, not the spot price of crude oil.

While the two may have appeared reasonably close in value at times, that clearly was not the case when the market became more volatile. The typical retail investor is not likely to have the experience never mind expertise in futures trading, and likely never had a grasp or understanding of the underlying investment in USO, never mind the fact that the price of oil futures contracts farther out in time are generally more expensive than the earlier or “front-month” contracts (because there is an associated cost of storing the commodity that is typically factored in).

Every month the USO fund would close out futures contract positions by buying the next rolling month’s futures contract, and as it is typically at a higher price, over time, investors holding the fund for many months — will typically lose money.

Did your financial advisor explain that this was never an investment product designed for retail investors?

Did he/she explain that this was not designed to be a “buy and hold” type investment?

Recently, due to Covid-19 the near term demand for oil declined worldwide, and the front-month contracts collapsed (even going negative), and the “spread” between the front-month contracts and those farther out have grown more disparate. As a result, when USO rolls out of the front-month contract into the next month out in the future, it will be paying a higher spread, or a more significant premium.

Investors holding USO are likely to lose money, and will continue to do so if this pricing disparity is repeated over several more months. These investment products are designed to be used by professional traders to hedge other strategic investment holdings. These investment products even though they are packaged as an exchange-traded fund (ETF) available to retail investors are not intended to be “buy and hold” investments for retail investor accounts.

If the same retail investor by the USO fund actually was interested in making an investment in the underlying futures contracts, the retail investor would be required to fill out all kinds of additional paperwork at the brokerage firm in order to open an account that could make those investments, and the financial advisor making the recommendations to the investor and handling that account would typically need additional FINRA licenses.

By USO being packaged as an ETF, there were no such regulatory requirements and therefore likely no such requirements set forth in the policies or procedures at the firm level.

As a result, some financial advisors and some retail investors likely found themselves in uncharted waters and massive investment losses followed.

Investors Trying to Recover United States Oil Fund

Losses (USO)

For many investors, a private FINRA arbitration customer dispute enables them to bring a claim and potentially recoup their investment losses from ETFs like United States Oil Fund. These customer disputes typically involve just paper discovery and no depositions, and they’re generally quicker and more efficient in comparison to traditional court lawsuits, as they provide a private forum to resolve disputes faster and efficiently.

Haselkorn And Thibaut, P.A. is a nationwide law firm specializing in handling investment fraud and securities arbitration cases. The two founding partners have nearly 45 years of legal experience.

We have filed numerous (private mediation) customer Customers who suffered investment losses concerning problems like Those matters mentioned previously. There are generally no depositions Involved, and these cases Fare usually handled on contingency with no Recovery, no commission stipulations. Experienced Consultation as a public service. Call today for more information at 1-800-856-3352or email us.