Investors at Aegis Capital, a retail brokerage firm, have alleged fraud and misrepresentation of investments, which reportedly caused them to lose billions. But that’s not all. Aegis also serves as an underwriter, and since 2010, it has been the sole underwriter of 186 offerings for 111 issuers, totaling $1.9 billion. Many of the stocks issued by nano stock companies were always on the verge of delisting and bankruptcy.

Aegis-underwritten offerings were bought into Aegis’s retail brokerage clients’ accounts and were re-traded in Aegis’ retail brokerage clients’ accounts at significant markups and markdowns. In addition, Aegis served as a market maker for many of the stocks it underwrote, receiving bid-ask spread revenue due to trades its brokers were strongly motivated to recommend.

Aegis allegedly provided inflated analyst coverage for many of the stocks it underwrote, relentlessly aggressive buy recommendations with stratospheric price targets even as the stock prices of virtually all the companies it underwrote plummeted close to $0.

Aegis’s roles as a retail brokerage firm, underwriter, market maker, and research analyst created a farm-to-table securities fraud supply chain. Aegis underwrote offerings that systematically and predictably failed in exchange for extraordinary compensation. Investors, including many of Aegis’ retail customers, allegedly suffered at least $3.0 billion in losses in recent years due to Aegis’ conduct.

Haselkorn & Thibaut (InvestmentFraudLawyers.com) is currently investigating the actions and sales of Aegis Capital. Call us at 1-800-856-3352 or fill out the free case review to determine your loss recovery options.

Aegis Capital’s Underwritten Offerings

Table of Contents

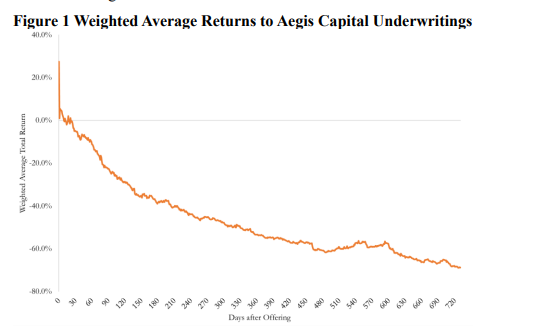

Aegis Capital’s sole-underwritten offerings are listed in Appendix 1 below. Table 1 reports the number and dollar value of Aegis sole-underwritten offerings by year from 2011 to early February 2024. The number and dollar values increased significantly over time.

- The weighted average 12-month return following an Aegis underwriting is -49.5%.

- The weighted average 12-month return in each year is negative except in 2020; even those offerings lost an average of 77.9% and underperformed the S&P 500 by 140.7% and microcap stocks by 84.6%.

- Investors lost $938,714,091 of the $1,896,433,478 invested in the first twelve months after an Aegis underwritten offering.

- The weighted average return to February 28, 2024 across Aegis underwritings is -75.4%.

- Investors lost $1,429,287,802 of the $1,896,433,478 invested in the Aegis underwritten offerings by February 28, 2024.

The Invitation to Mischief in Underwritings

Instructions for S-3 and F-3 registrations require that an offering be no more than 1/3rd the value of issuers’ shares held by unaffiliated investors if the market value of shares held by unaffiliated investors is less than $75 million.

The instructions invite issuer and underwriter abuse by allowing the value of shares held by unaffiliated investors to be calculated by multiplying the current shares held by nonaffiliates by the highest closing price in the prior 60 days. Underwriters and Issuers are incentivized to overstate the number of shares held by nonaffiliates and to search for, even manufacture, the highest possible price over the prior 60 days.

We see at least three examples wherein Aegis or the Issuer appears to have marked the close, so an issue can be much larger than would otherwise be allowed.

Someone Marks the Close in Meten Holding Group / BTC Digital

Meten EdtechX was created in a SPAC transaction on December 12, 2017, when EdtechX Holdings Acquisition Corp acquired Meten Education. Meten was a Chinese firm that provided online and offline English language training.

In late 2022, Meten abandoned its ELT business and swapped stock for Bitcoin mining machines. It then renamed BTC Digital and changed its ticker from METX to BTCT.

Aegis, the sole underwriter, underwrote four Meten offerings and received over $9 million in fees.

- Aegis justified the first Meten offering of $40 million by referencing the highwater closing price in the previous 60 days, six weeks before the offering.

- Aegis issued research analyst reports touting Meten, maintaining a $3 price target as the stock price dropped from $1 to $0.01.

- Marking the Close: Aegis and Meten justified the $60 million September 1, 2021, issuance based on the $0.92 closing price on September 1, higher than any closing price in the prior 60 days and higher than any closing price since. Meten’s stock was manipulated to close above $0.89 on September 1, so the value of its stock held by nonaffiliates would exceed $75 million.

How Can Investors File FINRA Arbitration Claims to Recover Losses?

If you’re an investor who has suffered losses due to Aegis Capital’s fraudulent activities, you can file a FINRA arbitration claim to recover your losses. Here’s how:

- Consult with a lawyer: You should consult a lawyer specializing in securities fraud to understand your legal rights and options. They can help determine if filing a FINRA arbitration claim is best.

- File a statement of claim: To file a FINRA arbitration claim, you need to submit a statement that outlines your losses, the reasons for your claim, and the relief you’re seeking. Your lawyer can help you draft the statement of claim.

- Wait for FINRA to assign an arbitrator: FINRA will assign a neutral arbitrator to your case. The arbitrator will review the statement of claim and the response from Aegis Capital and schedule a hearing.

- Prepare for the hearing: Your lawyer will help you prepare by gathering evidence, interviewing witnesses, and arguing your case.

- Attend the hearing: You and your lawyer will attend the hearing and present your case to the arbitrator. The arbitrator will make a decision based on the evidence presented.

- Receive the award: If the arbitrator rules in your favor, you’ll receive an award that orders Aegis Capital to pay you the amount you’re owed.

Filing a FINRA arbitration claim can be complex and time-consuming, but it’s worth it if it means recovering your losses. Don’t let Aegis Capital get away with its fraudulent activities. Take action and fight for your rights as an investor.