William Worthen King, also known as Bill King, is a stockbroker currently employed by Merrill Lynch, Pierce, Fenner & Smith Inc. He has been with the firm since 1985, working in offices in New York City, Vero Beach, Florida, and Chester, New Jersey. Recently, King (CRD# 7691) has faced multiple customer complaints alleging unauthorized trading and failure to implement risk management strategies, which has allegedly led to significant investment losses for his clients.

Haselkorn & Thibaut (InvestmentFraudLawyer.com) is currently investigating Bill King. If you or a loved one has experienced investment losses due to the actions of William Worthen King or any other broker. In that case, it is important to seek legal representation as soon as possible. Investors can call our toll-free number at 1-800-856-3352 to schedule their free consultation.

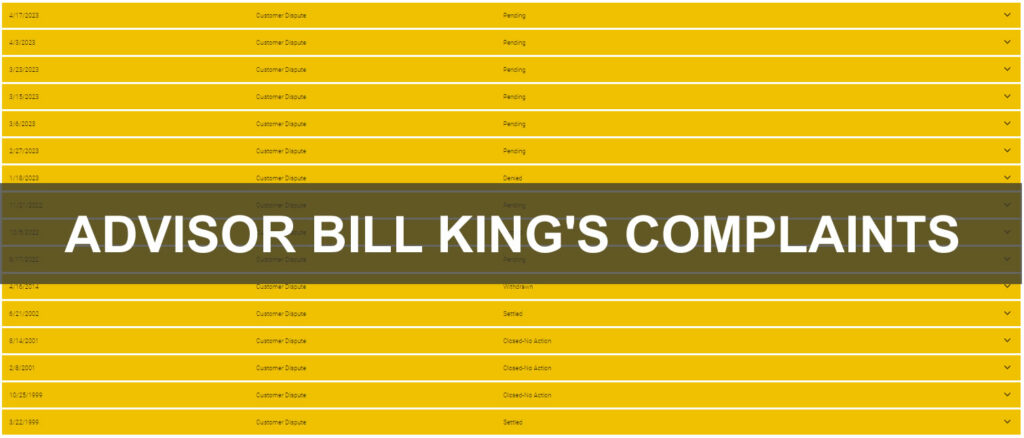

Bill King Has Multiple Customer Complaints

Table of Contents

According to FINRA’s BrokerCheck, Bill King has been the subject of several customer complaints, with clients alleging that he was not acting in their best interest when enrolling their brokerage accounts into a managed strategy. The complaints claim that King failed to implement risk management strategies, leaving their portfolios open to market volatility and resulting in substantial financial losses.

One such investor complaint alleges damages of $600,000 due to King’s failure to recommend investments in the customer’s best interest when enrolling their brokerage account in a managed strategy. In another pending dispute filed on August 17, 2022, several investors made similar allegations against King, seeking $600,000 in damages.

Other claims against King include allegations of unauthorized and unsuitable trades in 2022, as well as unauthorized sales for tax losses. These claims are currently pending.

Examples of Bill Kings Compla

Complaint November 2022: Client Complaint

Current Status: Under Investigation

Claims: The client has raised concerns over unauthorized option trades executed between June and September 2022.

Revised Issue of August 2022: Customer Complaint

Current Status: Under Review

Accusations: The client accuses the financial consultant of negligence, claiming that the broker failed to act in the client’s best interest by enrolling the client’s brokerage account into a managed strategy without applying risk mitigation strategies, leaving the portfolio susceptible to market fluctuations.

Requested Compensation: $600,000.00

Complaint June 2002: Customer Issue

Status: Resolved

Allegations: The client claimed that they were misled at the time of purchasing a variable annuity. No precise damage was stated.

Broker Response: The client received a death benefit guarantee with a 5% growth option on invested premiums. The final settlement amount will only be ascertained upon filing of a death claim.

Complaint March 1999: Customer Grievance

Status: Resolved

Allegations: The client lodged a complaint about his Merrill Lynch consults accounts, alleging that certain false statements were made concerning fees and performance. Furthermore, he claimed that tax loss sales exceeded the authorized amount. No specific damage amount was alleged. This incident occurred at Merrill Lynch.

Settlement Amount: $49,000.00

Broker Comment: To evade the costs and unpredictability of a legal battle, and to show goodwill towards a valued client, the firm decided to settle the issue for $49,000. The client had multiple Merrill Lynch consults accounts managed by an external advisor chosen by the client. The service fee for this arrangement is a percentage of the total asset value in the portfolio.

How Investors Can Recover Losses from Bad Financial Advisors

As an investor, you trust your financial advisor to make sound investment decisions on your behalf. However, there may be situations where your advisor fails to act in your best interests, leading to significant losses in your investment portfolio. If you find yourself in this unfortunate situation, there are steps you can take to recover your losses.

Understanding the Problem

It is essential to understand the problem before you can seek a solution. Financial advisors may cause losses through negligence, misconduct, or fraud. Negligence refers to situations where an advisor fails to exercise reasonable care in managing your investments. Misconduct is a broader term that includes intentional wrongdoing, such as making unsuitable investment recommendations or engaging in unauthorized trading. Fraud occurs when an advisor makes material misrepresentations or omissions about an investment or engages in other deceptive practices.

Filing a Complaint with FINRA

The Financial Industry Regulatory Authority (FINRA) provides a forum for investors to resolve disputes with their financial advisors. If you believe that your advisor has caused losses due to negligence, misconduct, or fraud, you can file a complaint with FINRA. FINRA offers several options for dispute resolution, including mediation and arbitration. If you choose to pursue arbitration, you will have a hearing before a panel of arbitrators who will decide the outcome of your case. It is essential to note that the decision of the arbitrators is binding, meaning that you cannot appeal the decision.

Importance of Investor Vigilance

These complaints and lawsuits against Bill King highlight the importance of investor vigilance when working with financial advisors. It is essential for investors to be proactive in understanding the strategies and recommendations provided by their advisors, as well as to monitor their account performance regularly. This level of engagement can help to identify potential issues early on and prevent significant financial losses.

Investors should also be aware of the warning signs of broker misconduct, such as unauthorized trading, unsuitable investments, and failure to implement risk management strategies. If any of these red flags are present, it is critical to consult with an experienced securities attorney who can evaluate the situation and provide guidance on the best course of action.

Need Legal Help?

If you or a loved one has experienced investment losses due to the actions of William Worthen King or any other broker, it is important to seek legal representation as soon as possible. Experienced investment fraud lawyers, such as those at Haselkorn & Thibaut, can help you navigate the complex legal process and fight for the compensation you deserve.

With a 98% success rate and over 50 years of combined experience, Haselkorn & Thibaut have recovered millions for investors nationwide. They offer a free consultation to evaluate your case, and they operate on a no recovery, no fee basis, which means you won’t be charged any fees unless they successfully recover your investment losses. You can contact Haselkorn & Thibaut at 1-800-856-3352 to schedule your free consultation.

In conclusion, the multiple complaints and lawsuits against stockbroker Bill King (William Worthen King) serve as a reminder of the importance of investor vigilance and proactive engagement with one’s financial advisor. If you believe you have suffered financial losses due to broker misconduct or negligence, it is crucial to seek legal representation from experienced investment fraud lawyers. With the right legal support, you can fight for the compensation you deserve and protect your financial future.