BrokerCheck is a free tool from FINRA that helps you research investment professionals and firms. It lets you search by name, number, or zip code to find detailed reports about their history, qualifications, and any problems they’ve had.

This service is great for checking the background of people in the securities and exchange industry. Knowing this information can help you make smart choices with your investments and stay away from fraud. Additionally, BrokerCheck includes information on registered representatives, highlighting the tool’s comprehensive nature in researching professionals in the securities and exchange industry.

FINRA, which stands for protecting investors like you, offers BrokerCheck as part of its mission. You can even download full reports to get all the details on advisors and brokers.

Using BrokerCheck is key to making clear decisions in finance because it brings everything into the open. Keep reading to discover how this tool works and why it’s important for your financial safety.

Key Takeaways

Table of Contents

BrokerCheck lets you look up the history of financial advisors and firms for free.

You can find details about people’s work, their qualifications, and any past problems within the last 10 years.

Using BrokerCheck helps avoid scams by showing if advisors or firms have broken rules before.

FINRA watches over brokers to keep your investments safe.

Tools on BrokerCheck help figure out risks and goals for your money.

What is FINRA Broker Check?

FINRA Broker Check is a tool for investors to research the background of investment advisors and brokerage firms, including how to register with the SEC and states. Accessible online, it provides information about individuals’ registration status and disciplinary history within the last 10 years.

https://www.youtube.com/watch?v=KzSX_CUkZto

The Securities and Exchange Commission plays a crucial role in the information provided through BrokerCheck, especially regarding the securities industry registration process.

Purpose and benefits

BrokerCheck by FINRA offers investors a powerful way to check the background of their investment advisers, professionals and brokerage firms before making any financial decisions. This free tool helps users verify qualifications, uncover any disciplinary history, and evaluate the professional conduct of brokers and investment advisers themselves.

Its purpose is simple: to increase transparency in the securities industry and provide protection for investors. By using BrokerCheck, people can make more informed choices about who handles their investments, which greatly reduces the risk of falling victim to fraud or incompetence.

Additionally, BrokerCheck empowers investors with critical information needed for making safer investment choices. Finding out how to access this valuable tool is easy.

How to access the tool

To access BrokerCheck, visit the official FINRA website.

Once on the site, locate the “BrokerCheck” tab in the top menu and click on it.

Enter the name, CRD/SEC number, employing firm (individual searches only), or zip code of the individual or firm you want to research.

Review the report summary for a snapshot of their employment history, qualifications, and disclosure events.

For more detailed information, download the full report for further investigation.

What Information Can You Find on Broker Check?

Broker Check provides details on individuals registered within the past 10 years, those whose registrations ended more than 10 years ago, and comprehensive information about brokerage firms and investment adviser firms. It also offers supplements to aid in effective background checks for investors and transparency in financial transactions. Additionally, BrokerCheck provides access to ‘Form ADV’ for investment adviser firms, detailing their registration and disciplinary history, which is essential for understanding the background and integrity of these entities. Through BrokerCheck, investors can access various forms, including Form ADV, to learn about an investment adviser brokerage firm*’s registration, business operations, and any disciplinary events involving the investment adviser brokerage firm* and its key personnel.

https://www.youtube.com/watch?v=joA7XV6Does

Individuals registered within the past 10 years

Individuals of registered representatives in the past 10 years can be easily searched using BrokerCheck. You can access detailed reports on registered representatives, their employment history, qualifications, and any disclosure events.

This information helps investors make informed decisions about who they choose to work with.

Investors can use this tool to research and verify the credentials of professionals before making investment decisions. It provides crucial insights into their track records and background, aiding in due diligence processes.

Individuals whose registrations ended more than 10 years ago

Past-time individuals’ registration details, including employment history and disciplinary events, could be accessed for due diligence on those regulated by FINRA BrokerCheck. This allows investors to review past experience and any historical disclosure events before engaging with an investment adviser firm, professionals or firms.

The tool provides a detailed report on their previous qualifications, aiding in making informed decisions.

The extensive information available on individuals whose registrations ended more than 10 years ago gives investors an first look at their money market funds and opportunity to gain insights into the long-term performance and conduct of these professionals look at money market funds now.

This equips them to make well-informed choices when considering working with these long-standing industry members. Understanding the track record of such individuals can offer investment adviser a valuable perspective when evaluating prospective investments.

Brokerage and Investment Adviser Firms

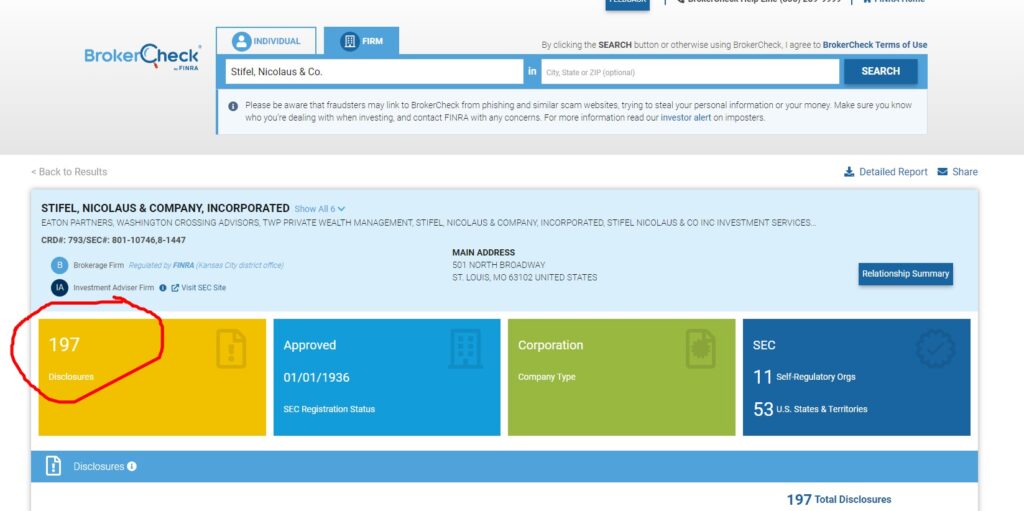

When exploring FINRA Broker Check, investors may also want to look into brokerage firms they are considering. This provides an opportunity to gain insight into the brokerage firm itself‘s background, its history of compliance and any reported disciplinary actions.

By using the tool, individuals can research important details such as the brokerage firm’s registration status, regulatory disclosures, and any customer disputes or arbitrations. This detailed information empowers investors to make informed decisions about which brokerage firms they choose to work with.

The search on BrokerCheck allows users to verify whether a brokerage firm is registered with FINRA and obtain essential data about its business operations and compliance history. Utilizing this resource equips potential investors with crucial knowledge that can guide them in selecting reputable and trustworthy brokerage firms for their investment needs.

Supplements to Broker Check

Supplements to Broker Check provide additional information beyond what is available on the standard report, offering deeper insights and context for investors. These supplements may include details such as professional designations, educational background, and other qualifications that can further inform investment decisions.

Understanding these supplementary materials can empower investors to make more informed choices when selecting which investment advisers, professionals or firms to work with. Moreover, by leveraging these supplemental resources, investors gain a comprehensive view of an individual or investment adviser firm’s or firm’s expertise and credentials.

Understanding FINRA’s Regulatory Role

Understanding FINRA’s Regulatory Role

FINRA plays a crucial role in regulating investment professionals and firms. To learn more, continue reading the blog.

https://www.youtube.com/watch?v=cQNYoZOHWgs

FINRA’s main mission

FINRA’s primary mission is to protect investors by maintaining fair and transparent markets. It oversees the securities industry and enforces compliance with its rules to ensure that investment professionals and firms operate with integrity.

Through regulation, FINRA aims to promote market integrity while providing essential safeguards for investors against potential misconduct or fraud.

This client focus underlines FINRA’s dedication to safeguarding investor interests in today’s dynamic financial landscape. By regulating broker-dealers and ensuring they adhere to ethical standards, FINRA works towards fostering trust and confidence in the securities market.

Regulations for investment professionals and firms

Regulations for investment professionals and firms are essential to ensure the integrity of the financial markets. Investment professionals, including brokers, financial advisors, and investment advisers, are required to adhere to strict registration requirements set forth by regulatory authorities.

These regulations aim to protect investors and uphold ethical standards within the industry. For instance, broker-dealers must obtain proper licensing and comply with capital acquisition broker or funding portal regulations as mandated and means to be regulated, by FINRA itself.

Similarly, registered investment adviser firms need means to register, and means to be regulated and navigate through complex financial regulations tailored towards their operations.

The regulatory framework not only underpins the ever-evolving realm of financial services but also serves as a protective measure for investors seeking more than just investment options; it unlocks the secrets behind trustworthy professionals and robust firms in the world of finance.

How to Use Broker Check Effectively

Use Broker Check’s tools, calculators, and related links for efficient searches and troubleshooting any issues; read more to maximize your experience.

Tools and calculators

BrokerCheck offers a range of helpful tools and calculators for investors to make informed decisions about their investments. These include:

Assessment Tools: Investors can utilize various assessment tools to gauge their risk tolerance, investment goals, and time horizon.

Background Affiliation Status Information Center (BASIC): This tool provides access to disciplinary and registration information for broker-dealer firms and their individual brokers.

Cost Calculators: Users have access to calculators that help them estimate the impact of fees on their investments over time.

Investment Professional Designations: The tool allows users to check the meanings and requirements of various professional designations in the securities industry.

Risk Meter: Helps investors understand the risk level associated with different types of investments, allowing them to make more informed choices.

Savings Goals Calculator: This calculator assists individuals in setting realistic savings goals based on their financial situation.

These resources empower investors with valuable insights into their investment decisions, ensuring they are well-equipped to navigate the complex world of investing effectively.

Related links and resources

Related links and resources:

Access FINRA’s official website to learn more about the organization’s mission and regulatory role in protecting investors.

Explore educational materials on investor awareness and protection, available on the FINRA website, to enhance your understanding of investment risks and potential red flags.

Utilize FINRA’s BrokerCheck user guide for detailed instructions on how to effectively navigate and interpret the information provided by the tool.

Visit the SEC’s website to access additional resources related to securities fraud, investor education, and investor alerts to stay informed about potential scams or fraudulent activities.

Engage with online financial communities or forums where investors share their experiences with BrokerCheck and discuss best practices for conducting thorough background checks.

Join webinars or workshops organized by FINRA that focus on investor protection, risk management, and strategies for making informed investment decisions.

Connect with local consumer advocacy groups or organizations that provide free resources for understanding investment products, spotting investment fraud, and protecting your assets from potential scams.

[First-Hand Experience]:

When I first started using BrokerCheck, I found these resources extremely helpful in gaining a better understanding of how to utilize the tool effectively while strengthening my knowledge of investment risks and protective measures.

Frequently asked questions

What type of information can I obtain from BrokerCheck?

The professional background of investment professionals, brokerage firms, and investment advisers.

Employment history, qualifications, and disclosure events of individuals.

How can I access BrokerCheck?

Users can access the tool for free directly from the FINRA website.

Searches can be conducted using the individual or firm’s name, CRD/SEC number, employing firm (individual searches only), or zip code.

Can I download detailed reports from BrokerCheck?

Yes, users have the option to download detailed reports for further investigation of a particular individual or firm.

Why is it essential for investors to use BrokerCheck before making investment decisions?

It helps investors verify credentials and disciplinary and employment history of professionals, aiding in making informed decisions and avoiding potential fraud.

What is FINRA’s role in providing BrokerCheck?

FINRA, as a non-profit organization authorized by Congress to protect investors, provides this tool to enhance transparency and investor protection in the financial industry.

Search tips and troubleshooting

To get search results and enhance your experience on BrokerCheck, consider the following search tips and troubleshooting advice:

Use specific keywords: Input precise terms like individual names or firm CRD numbers to narrow down search results efficiently.

Utilize advanced search filters: Apply location-based criteria, employing firm details, or zip codes to streamline your search.

Verify information accuracy: Cross-reference multiple sources to validate the information found on BrokerCheck reports.

Explore related resources: Extend your research by delving into additional databases or professional networking sites for supplementary insights.

Report any issues: If you encounter technical difficulties or suspect inaccuracies, promptly notify FINRA’s support team for resolution.

Seek professional guidance: In case of complex discrepancies, consider consulting a qualified financial advisor for further assistance.

These tips and steps can help optimize your search results for use of BrokerCheck and address any potential challenges you may encounter during your research process.

Why Use FINRA Broker Check?

Why utilize FINRA Broker Check? It provides transparency and safeguards for investors.

Importance of performing background checks

Performing background checks is crucial in the realm of the investment adviser. It ensures that investors can verify the credentials and disciplinary history of professionals, such as brokers and firms, before entrusting them with their hard-earned money.

By using tools like BrokerCheck provided by FINRA, investors can make informed decisions and avoid potential fraud or unqualified professionals. This level of due diligence underpins transparency and offers protection to investors, empowering them to navigate the complexities of the financial world confidently.

Investors should utilize BrokerCheck’s comprehensive reports to understand the track record of individuals or firms they are considering working with. The tool provides a detailed summary covering employment history, qualifications, disclosure events, allowing investors to dive into first-hand facts about these professionals.

Transparency and protection for investors

Investors gain transparency by accessing BrokerCheck, providing the disciplinary history and qualifications of brokers and firms. This aids informed decision-making, shields against potential pitfalls, and supports investor protection.

Moreover, it enables investors to verify background information before finalizing investment decisions, safeguarding them from fraudulent or unqualified professionals who may pose financial risks.

By using this tool, investors can ensure that they are partnering with reputable professionals in the securities industry.

Utilizing BrokerCheck effectively is crucial for due diligence before making investment choices to protect investors from potential frauds or unqualified professionals while promoting informed decision-making.

Conclusion

Navigating FINRA Broker Check gives investors vital details before making decisions. This tool shines a light on the backgrounds of brokers and firms, ensuring transparency in the financial world.

FINRA plays a crucial role by overseeing investment advisers and professionals, emphasizing its mission to protect investors. The Broker Check service offers insight into the history and qualifications of the advisers and those within the securities industry, including any disciplinary actions taken against them.

Using Broker Check is straightforward thanks to user-friendly tools and resources available online. These include calculators for better understanding investments and links to additional information that can guide users through their research process.

Checking backgrounds with this free tool is essential for investor protection. It ensures that individuals are well-informed about whom they’re dealing with in their investment ventures.

The value of using FINRA Broker Check cannot be understated means to be regulated for anyone looking into investing or managing their portfolio more effectively.

FAQs

1. What is FINRA Broker Check?

FINRA Broker Check is a tool that helps you find out if broker-dealers, capital acquisition brokers, and funding portals are registered.

2. Why should I use FINRA Broker Check?

You should use it to check the background of the investment advisers and registered broker-dealers before making investment decisions. It ensures they are officially registered.

3. Can I see a broker’s history with FINRA Broker Check?

Yes, you can see if broker-dealers or capital acquisition brokers have any past issues or records that might affect your decision.

4. How do I start using FINRA Broker Check for my investments?

To start, go to the FINRA website and search for the name of the brokerdealer or funding portal you’re interested in learning more about.