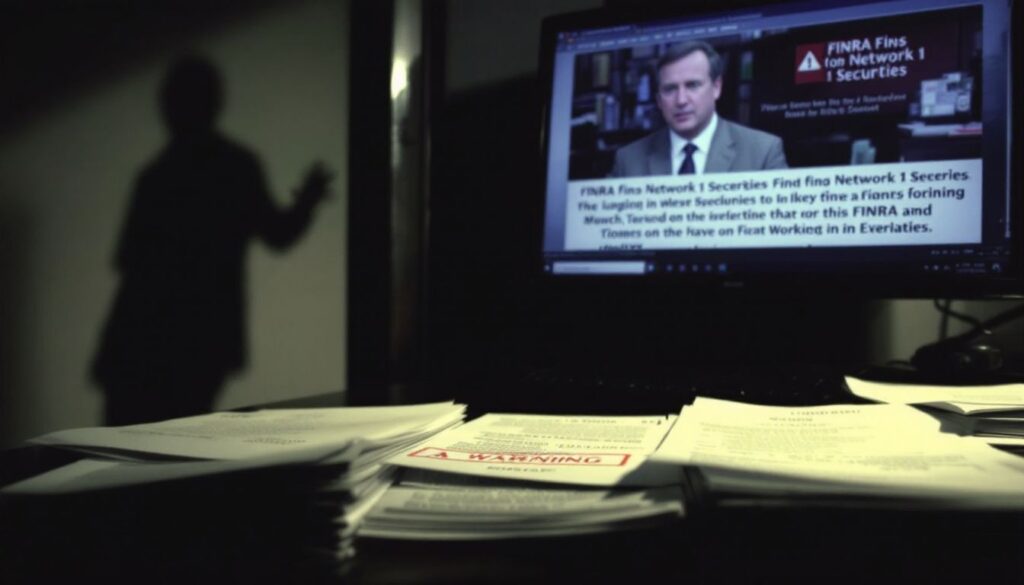

Network 1 Securities faces a $740,000 penalty from FINRA for failing to protect against money laundering. The financial watchdog ordered the firm to pay $200,000 in fines and $534,000 in restitution on August 31, 2023.

FINRA also suspended Michael Molinaro, the firm’s anti-money laundering compliance officer, and fined him $5,000. This marks his second suspension after a previous 45-day ban in 2015 for similar violations.

Haselkorn and Thibaut, P.A. stand ready to help investors affected by these compliance failures. The case shows us why strong anti-money laundering programs matter in protecting investors’ interests.

The details of this case reveal serious gaps in financial security measures. Learn what this means for your investments.

Key Takeaways

Table of Contents

- FINRA fined Network 1 Securities $200,000 on August 31, 2023, with total penalties reaching $740,000, including $534,000 in restitution payments.

- The firm failed to maintain proper anti-money laundering controls from January 2018 through March 2019. They missed red flags in customer accounts and didn’t file required suspicious activity reports.

- Michael Molinaro, the Chief Compliance Officer, received a $5,000 fine and three-month suspension. This marked his second suspension after a 45-day ban in 2015 for similar issues.

- FINRA’s action shows their strict enforcement of Bank Secrecy Act rules. The case highlights the importance of maintaining strong compliance programs to detect suspicious transactions.

Background of the Violation

Network 1 Securities failed to create and maintain a proper anti-money laundering program from January 2018 through March 2019. The firm’s Chief Compliance Officer missed several red flags in customer accounts and didn’t file the required suspicious activity reports to the Financial Crimes Enforcement Network.

Network 1 Securities fined for lack of compliance program

The Financial Industry Regulatory Authority slapped Network 1 Securities with a $200,000 fine on August 31, 2023. We found that the firm failed to maintain proper anti-money laundering protocols and compliance programs.

The total penalty reached $740,000, which includes both fines and restitution payments of $534,000 to affected parties.

Our investigation revealed serious gaps in the firm’s financial crime prevention measures and suspicious transaction monitoring systems. The consent order shows clear violations of the Bank Secrecy Act requirements for customer due diligence.

These failures led FINRA to issue a censure as part of the settlement agreement, marking a significant enforcement action against the securities firm’s compliance practices.

AML compliance officer suspended

Michael Molinaro faced serious consequences for his role as Chief Compliance Officer at Network 1 Securities. We observed that FINRA imposed a $5,000 fine and suspended him from principal capacities for three months due to compliance failures.

This marks his second suspension, following a previous 45-day ban in 2015 for similar supervisory issues related to anti-money laundering protocols.

Our financial industry demands strict adherence to regulatory compliance and suspicious transaction monitoring. Money laundering poses significant risks to customer accounts and market integrity.

FINRA’s action against Network 1 Securities shows their commitment to maintaining strong BSA/AML standards. Compliance officers must conduct thorough risk assessments and maintain proper documentation to prevent illegal activity and financial fraud.

Importance of Compliance Programs in the Financial Industry

Strong compliance programs serve as the backbone of financial firms’ operations. We must follow strict rules set by the Bank Secrecy Act and anti-money laundering regulations to protect our industry.

FINRA Rule 3310 guides firms to create solid written policies that catch suspicious transactions. These programs need regular testing to make sure they work well.

Financial firms need clear paper trails and proper customer identification steps to spot fraud risks. Our staff needs constant training to spot signs of money laundering in customer accounts.

The Financial Crimes Enforcement Network requires us to file reports about strange activities through their system. Regular updates from regulators help us stay current with new rules, especially during market changes.

A good compliance system helps us catch problems before they grow into major issues.