SagePoint Financial Advisors, a subsidiary of the Advisor Group, has been censured by the Financial Industry Regulatory Authority (FINRA) and a fine of $700K levied for failing to supervise brokers who had a misconduct history. According to a letter of acceptance, waiver, and consent (AWC) shared by FINRA, the findings in this case against SagePoint include:

• Lack of written procedures

• Lack of a system of supervision

• Failure to assign responsibility for a higher level of supervision and possible disciplining of brokers with a past misconduct record

The findings trace these issues from 2013 onwards. Even though two departments existed in the firm that was supposed to do this, a lack of understanding and clarity on working with each other apparently led to things falling through the cracks.

As a result of these actions, Haselkorn & Thibaut has opened an investigation into the sales practices of SagePoint Financial and its financial advisors. SagePoint investors are encouraged to call 1-800-856-3352 for a free review of their portfolios.

SagePoint Financial background

Table of Contents

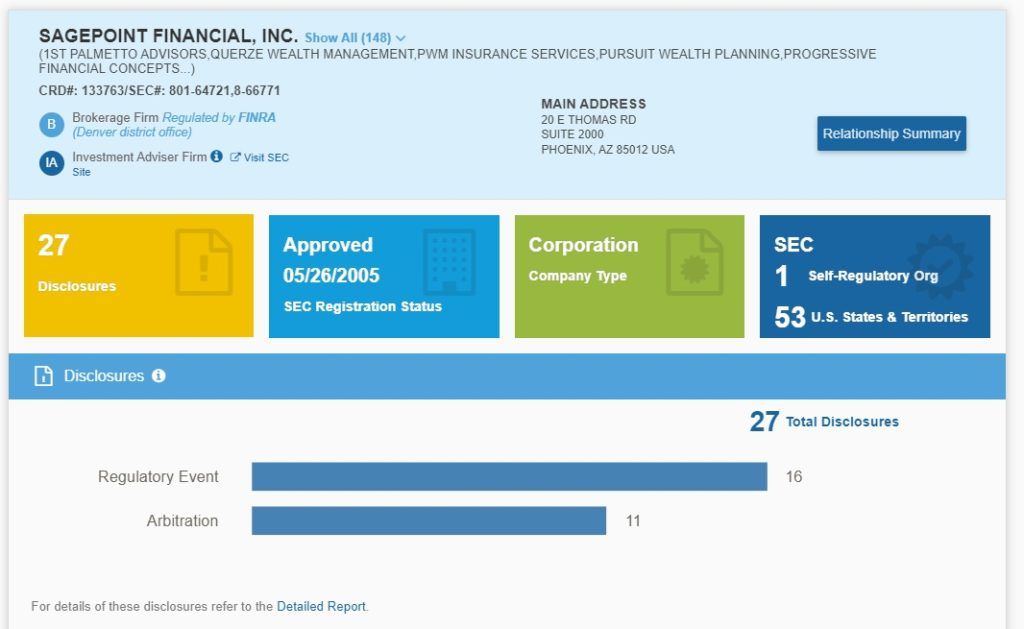

SagePoint Financial launched as a broker-dealing agency in 1970 and was registered with FINRA. The firm also sold investments. In addition, it was registered with the US-based SEC to offer investment advisory products and services in 2005.

The firm is a subsidiary of the Advisor Group, Incorporated. This business is comprised of one of America’s leading network-owned independent stock-based brokerage firms, which operates across multiple tiers of investment banks and brokerage firms.

SagePoint Complaints & Response

FINRA’s investigation into SagePoint has caused concern by industry experts. FINRA terms its recordkeeping on disciplinary issues as ‘haphazard and fragmented’ which in itself may have been a hindrance for its staff’s ability to access the disciplinary history of brokers in need of being placed under a heightened level of scrutiny, further preventing them from doing so. The firm maintained two databases. Only one of the two maintained a record of the 700 plus brokers with past misconduct on their profile.

The AWC goes on to infer that the end result of the multiple failures was the firm’s failure, or inability, to follow up on brokers who needed following up because they presented a greater risk of misconduct.

Between the 700 brokers with a disciplinary history, 1,500 disciplinary letters have been issued by the firm. Of these 700, there are 132 who have received three or more such letters. 11 brokers, between them, accounted for 110 disciplinary letters. However, in a complete breakdown, SagePoint failed to impose a heightened level of supervision on any of them, as found out by FINRA. There is some evidence of these 11 brokers being fined, but there is no data to demonstrate that the fines were based on the nature and frequency of their infractions.

Without a system to report “multiple instances of violative misconduct” by brokers, SagePoint was running blind, and could not report these 11 to FINRA as they should have.

In addition to the fine imposed, SagePoint is required to review the conduct of each broker who has been the recipient of disciplinary action of the firm. Further, the review findings have to be reported to FINRA within 120 days of the issuance of the AWC.

The sanctions have received the consent of SagePoint who have neither accepted nor denied the findings of FINRA.